Is a Non-FDA drug or service authorized under FS 440 et seq

My workers compensation authorized treating doctor (ATP) has recommended a non-FDA approved experimental drug; however this has been denied by Worker’s Compensation — is this par for the course? The response to most legal questions is “it depends” and in this situation it truly does depend on several factors.

Pursuant to FS 440 et seq, compensable medical care does not include services or medication that are experimental, investigative in nature or part of a research project. However, an exception arises if the Department of Financial Services (DFS) gives prior approval. The Department must decide each situation on a case-by case basis as no two cases are alike. Keep in mind, prior to January 1994, this was the responsibility of the DFS however effective October 2003, the legislature repealed the exception noting that experimental or investigative services are not compensable.

Now the term “experimental” includes medical services, procedures, drugs, equipment, or supplies. These are considered experimental if their efficacy has not been proven for a particular diagnosis, or if their safety and validity is unclear or unknown. Likewise, the term investigative includes these same services and devices when they are known to be safe but their efficacy is still under investigation. Before denying a claim for medical treatment on the argument that the treatment is experimental or investigative the carrier must first refer the request for treatment to the Department of Financial Services.

Now the term “experimental” includes medical services, procedures, drugs, equipment, or supplies. These are considered experimental if their efficacy has not been proven for a particular diagnosis, or if their safety and validity is unclear or unknown. Likewise, the term investigative includes these same services and devices when they are known to be safe but their efficacy is still under investigation. Before denying a claim for medical treatment on the argument that the treatment is experimental or investigative the carrier must first refer the request for treatment to the Department of Financial Services.

Florida Injury Attorneys Blog

Florida Injury Attorneys Blog

Third: What is my hearing loss worth? Compensation for total loss of hearing in one ear is fifty-two (52) weeks and compensation for total loss of hearing in both ears is two hundred (200) weeks. How much loss you have in your hearing can be determined by the results of an audiogram. Next the calculation is made to find out how much compensation you could be entitled to based on your average weekly wage while working for your employer. Let us say for example you worked earning roughly $1,000.00 per month. This would result in an average weekly wage of roughly $230.77 ($12,000 per year divided by 52 weeks). The proper compensation rate would be two-thirds of your average weekly wage, so in this example, the compensation rate would be $153.85. Now let us say, by calculating your audiogram, that you have suffered a 30% loss in both of your ears, also known as binaural hearing loss. To determine how much you could be entitled to for compensation, you would take the 200 weeks (as indicated by the scheduled list in Section (8) of the Act) and multiply by 30% which would equal 60 weeks. This means you could be entitled to 60 weeks’ worth of compensation at a rate of $153.85, which would equal roughly $9,230.40. We also litigate to get you hearing aids if you want them.

Third: What is my hearing loss worth? Compensation for total loss of hearing in one ear is fifty-two (52) weeks and compensation for total loss of hearing in both ears is two hundred (200) weeks. How much loss you have in your hearing can be determined by the results of an audiogram. Next the calculation is made to find out how much compensation you could be entitled to based on your average weekly wage while working for your employer. Let us say for example you worked earning roughly $1,000.00 per month. This would result in an average weekly wage of roughly $230.77 ($12,000 per year divided by 52 weeks). The proper compensation rate would be two-thirds of your average weekly wage, so in this example, the compensation rate would be $153.85. Now let us say, by calculating your audiogram, that you have suffered a 30% loss in both of your ears, also known as binaural hearing loss. To determine how much you could be entitled to for compensation, you would take the 200 weeks (as indicated by the scheduled list in Section (8) of the Act) and multiply by 30% which would equal 60 weeks. This means you could be entitled to 60 weeks’ worth of compensation at a rate of $153.85, which would equal roughly $9,230.40. We also litigate to get you hearing aids if you want them.

The last employer rule specifically applies in occupational disease cases.

The last employer rule specifically applies in occupational disease cases.  Did you know that there exists time period in which you must file your Defense Base Act claim in order to be eligible for compensation checks? Have you been told by an adjuster from one of the infamous insurance companies like Gallagher Bassett or AIG that your “statute has run”? In reality, your statute may not have expired at all! As an initial matter, there exists no time limit for medical treatment. This means that even if you had your injury 20 years ago, you are still eligible to file a claim for medical treatment! Medical treatment is never time barred (unless you settle your claim for a lump sum of money, then your medical claim usually closes forever).

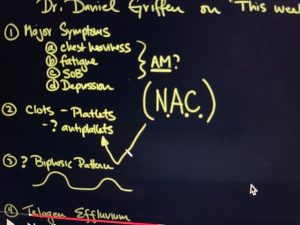

Did you know that there exists time period in which you must file your Defense Base Act claim in order to be eligible for compensation checks? Have you been told by an adjuster from one of the infamous insurance companies like Gallagher Bassett or AIG that your “statute has run”? In reality, your statute may not have expired at all! As an initial matter, there exists no time limit for medical treatment. This means that even if you had your injury 20 years ago, you are still eligible to file a claim for medical treatment! Medical treatment is never time barred (unless you settle your claim for a lump sum of money, then your medical claim usually closes forever). Because London was hit early and hard with this disease, I am directing you to these youtube videos for people who have symptoms lingering after two weeks.

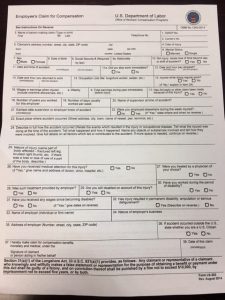

Because London was hit early and hard with this disease, I am directing you to these youtube videos for people who have symptoms lingering after two weeks.  while working overseas for a U.S. contractor/company and which can also provide you with compensation for medical treatment. The first step in filing a Defense Base Act claim is to seek and have proof of medical treatment for any work-related injuries you may have suffered on the job. The injuries you suffered can be physical or mental health injuries or both. Generally, there is a one-year filing deadline to make a claim for benefits after the work-related injury occurred. Filing a DBA claim for PTSD can be more complicated because the symptoms may not arise until after the 1-year deadline has passed. However, PTSD is generally considered an occupational disease which can extend the filing deadline to two-years after knowing of the injury. Here is the form you can use to file your DBA claim. It is called an

while working overseas for a U.S. contractor/company and which can also provide you with compensation for medical treatment. The first step in filing a Defense Base Act claim is to seek and have proof of medical treatment for any work-related injuries you may have suffered on the job. The injuries you suffered can be physical or mental health injuries or both. Generally, there is a one-year filing deadline to make a claim for benefits after the work-related injury occurred. Filing a DBA claim for PTSD can be more complicated because the symptoms may not arise until after the 1-year deadline has passed. However, PTSD is generally considered an occupational disease which can extend the filing deadline to two-years after knowing of the injury. Here is the form you can use to file your DBA claim. It is called an